For well over a decade Central Banks in G7 economies have been pursuing loose monetary policies (Quantitative Easing and low interest rates) to avert deflationary risks in the aftermath of global financial crisis and been wishing for inflation. Now that they have got what they wished for, they are dreading it! The sudden spike in inflation has sent Central Bankers into a state of anxiety and they are now playing a catch-up mode.

How did we get here?

a)

Covid related supply disruptions

In March 2020, WHO declared Covid as a pandemic and this led

to lockdowns in many countries and regions as a response to contain the rapid spread

of the pandemic. As a result, there was

a sudden stoppage in economic activity as the duration of the lockdowns kept

increasing. To counter the adverse

effect of lockdowns on the economy, Governments and Central Banks across the

world adopted unprecedented measures ranging from cash support to credit

concessions to fiscal stimulus, and monetary policy actions to restore

stability and to keep the economy moving.

Central Banks dropped the already low interest rates to near zero as a

response to the Covid shock.

As economies began to open slowly, the consumer demand

bounced much quicker while production had not been fully restored. The on-going impact of Covid in different

countries meant that there was a large enough disruption in the manufacturing

sector. This led to supply chain

disruption, resulting in inflation perking up. The ongoing trade disputes are further

worsening the supply chain problems.

b)

Inflation fuelled by Oil price (and

other commodity prices)

Oil price, which dropped to $25/bbl during Q2/2020,

recovered to an average of $70/bbl from Q2/2021 as economies opened fueling

demand following successful vaccination programmes leading to a containment of

the pandemic. The Russian invasion of

Ukraine in late Feb 2022, that was quickly followed up with economic sanctions

on Russia, resulted in Oil prices spiraling beyond $100/bbl mark adding further

fuel (pun intended) to the already rising inflation caused by supply chain

disruption.

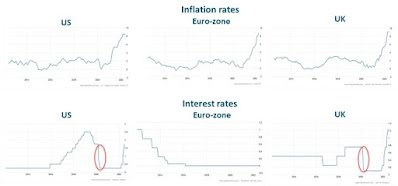

Central Banks have been behind the curve

Central Banks were cautious in their monetary policies in

Q3/Q4 2021 even as inflation figures were showing a rising trend. Their primary concern was not to derail the

fragile recovery following Covid related economic decline and the expectation

was that inflation would fade. Well, that didn't quite play to their expectations.

Clearly, they were behind the curve in their actions and are now pushed into a catch-up mode to contain runaway inflation, particularly in the US, where aggressive interest rate hikes are in train. While we can expect ECB and BoE take a more moderated and nuanced approach, the cycle of rates seems to be headed higher in the near term, until of course it pushes the respective economies into contraction.

In the short-term Inflation is likely to get worse

The inflation is likely to worsen further due to the ongoing

demand from labour for wage hikes to meet rising food costs, soaring energy

bills, and depleted spending capacity. There have been large scale protests by

Unions for wage hike as people struggle to balance their budget. Further increase in interest rates will

squeeze the spending and cause further economic pain to the already suffering

masses. There is a risk of wage increase feeding into inflation while impact of

rates is likely to have a lagged effect.

Some economies are having disproportionate impact of rising

prices with countries like Sri Lanka, Afghanistan, Myanmar and many others facing

food and energy shortages and many forced to skip meals due to lack of means.

This situation is not likely to be addressed without political leadership from

G-20 nations to support these economies in their economic and social hardships.

Are interest rates rises sufficient to tame inflation?

If the

only tool you have is a hammer, every problem looks like a nail!

Unfortunately, this is the position of Central Banks. While they are mandated to control inflation but have limited tools to achieve that. Monetary policies have its limitations and are not necessarily the right tool for every situation (e.g., supply chain shock). Furthermore, monetary policies have a lagged effect on inflation.

Increasing interest rates alone is not going to get us out

of this difficult economic conundrum. If anything, aggressive interest rate

hikes will lead to the recession as it will deplete demand without necessarily

addressing the core issue of supply chain disruption and high oil prices. And once the economy gets into stagflation,

it will become extremely difficult to reverse it.

While the US FED is likely to pursue its aggressive interest

rate actions, the ECB and BOE are likely to be more moderated in their actions

as they acknowledge the limitations and unintended consequences.

What other actions would help?

Besides some action on interest rates, there needs to be a

concerted action to address the following key issues, as monetary policies on

its own cannot resolve the current economic situation.

·

Actions to tame Oil Price – As higher

energy prices cause cost push inflation; it is extremely important that this is

addressed urgently. Securing higher production from OPEC, increasing shale oil

production, releasing oil reserves, and lastly rapid investment in renewable

energy to reduce dependence on Oil (though this is not a short-term solution).

·

Supply chain disruption – Restoration of

production and easing of transport and logistics are essential to control price

inflation caused by supply chain disruption. Addressing this could require fiscal

incentives, credit concessions and other policy support measures to support the

manufacturing, and transport and logistics sector.

·

Trade/Tariff barriers - This will require

leadership from G-20 nations to rise above their current disputes as there is a

bigger and common economic issue facing the global economy.

·

Essential Commodities – Release surplus food

stocks to curb price inflation and channel to countries in dire need. This would require greater coordination and

leadership amongst G-20 nations.

·

Resolve political impasse – While this is

the most obvious cause for the runaway spiraling of inflation, this is also

the most difficult one to resolve. The significant economic shock to many

countries reliant on commodities imports following Russia’s invasion of Ukraine

causing economic pain is telling. With

each passing day, the situation is getting further worse with ratcheting up of

the political rhetoric on both sides. Commodity

prices can remain elevated for a considerable period of time, despite monetary

policy actions, if the political impasse continues. JP Morgan estimates that under an extreme

scenario, Oil price could even get to $380/bbl.

That would be catastrophic for many economies reliant on oil imports.

In Summary

The issue of high inflation cannot be fully addressed by

aggressive interest rate hikes alone. Despite

this, Central Banks are mandated to curb inflation with limited tools at their

disposal. They will act with the only tool that they have i.e., monetary policy

actions as do not have much else to demonstrate that they are acting on

inflation.

Political leaders need to step up to the challenge and work

together to address this global challenge of looming stagflation. The

underlying causes of low growth, and high inflation need to be addressed that

requires concerted action on restoring supply chain, an interim agreement on

Trade and tariff and a firm resolve to address with Political conflicts.

We are in for a scorching summer, one that is not just

due to the heat alone. The red hot inflation is about to get hotter!

No comments:

Post a Comment