Recently, I gave a talk on above subject at a European CFO seminar in London. Here’s the gist of my talk!

Generally when Finance professionals

get innovative it’s usually followed by an accounting scandal! Well, I am not

talking about that kind of Innovation here!

We usually associate innovation with Consumer Electronics, Mobile Phones, Automobiles etc. where newer models pop up with alarming frequency.

Banking is usually not known for innovation, at least not at a pace that other industries have been accustomed to.

Let’s look at a few examples of

technology changing our world in recent history.

1. Technology

is mercilessly redefining business models.

'Disruptive Innovation' occurs when a product or service takes hold in simple applications at the small end of a market and then rapidly takes over the market by storm and eventually displaces well established players.

Some examples of disruptive innovation are given below:

- the music industry with online downloads (iTunes, Spotify etc.) making record company’s bankrupt (HMV, Tower Records);

- changing customer behaviour leading to the emergence of online shopping (Amazon, eBay etc.) and disruption the high street retail stores;

- Wikipedia made Encylopaedia Brittanica, a 332 years old print business, extinct;

- Netflix gobbed up video rentals like Blockbuster;

- online news channels now ‘erasing’ the print media; inflation adjusted there was less money spent on print ads last year than in the 1950s!;

- Google erased 85% of the market cap of the top GPS companies after it launched its mobile maps app! and

- television viewership is dropping as customer behaviour is increasingly moving towards the internet. For instance there are 4 billion views on YouTube every day!

Eastman Kodak had a dominant of the

market share for much of the 20th century and had 90% yet in

the 90s ran into difficulties with the advent of digital photography. It

went into bankruptcy and had to sell its patents to emerge as a lean company

now focusing on document imaging and personalized digital imaging only.

It took Apple only 5

years to the largest music company in the US and 7 years to be the largest in

the world on the back of the launch of their iTunes 99c song downloads!!!

Amazon started as online bookstore and

was seen not much of a threat.

When it launched Kindle and other eBook readers

emerged, customer behaviour shifted.

When Amazon launched Kindle and Apple its iBooks, they killed the demand for physical books substantially.

Barnes & Noble revenues declined but survived as it had an

online presence and had launched its Nook. Borders closed down.

Incidentally, Borders had outsourced its online operations to Amazon!!!

Amazon today is 2nd largest

ecommerce company as the changing customer behaviour to online shopping and putting high

street retail stores out of business; Turnover of $75bn (China’s Alibaba is the biggest at twice the size of Amazon).

2. Changing

customer behaviour driving the pace of innovation

Technology has caused a radical shift

in behaviour of people. The arrival of Internet and now with Smartphones and

tablets, the pace of change has been phenomenal!

We read on the Kindle or iPad, listen

to music on iTunes or Spotify, buy & sell on Amazon/eBay, communicate

using WhatsApp, and socialise with people on Facebook, express views through

Twitter and catch up our favourite programs on YouTube….

Internet came along in 1994. If you think about it, anyone under 40 years of age and in employment has always been accustomed to the online world!!!

Internet has become an integral part of

our lives and it has been given a massive boost by technology such as

Smartphones & Tablets and wearable tech will only boost this further.

The younger generation has been

adapting technology like never before! In fact, people want wi-fi more than

their coffee!

...but what has all this got to do with

banking?

Banking is a highly regulated business

and banks should be not impacted by this....right?

WRONG!

With technology taking over most aspects of our life, there is little to indicate that

banking might be an exception to the rule, there’s still enough time for banks

to act before it’s too late. They end up

looking at their Living Wills instead!

When was the last time when you went in

to a bank? How many of you still use cheque books?

We use ATMs to draw cash, remit using

online bank transfers etc. People do not want to spend time at a bank branch. Yet

we still see banks spending on upgrading the brick and mortar network...

3. The

emergence of FINTECHs

Disruption is the latest buzzword in the Fintech industry. Young entrepreneurs are transforming traditional industries and everyone wants a piece of the most profitable sector of the past few decades – the financial sector.

Increased digital disruption led by

technological innovation is leading to new market participants in the traditional

banking domain.

Financial technology or Fintech

start-ups are invading the banking space piece by piece. The first one to fall

victim is the payments business.

Payments

The hottest space is payments, as

evidenced recently; even the mighty Apple wants a piece of the pie.

Square, Stripe, Dwolla, Google wallet, PayPal to name a few have entered

the payments business, traditionally a banking domain.

Even companies have started managing

their customer’s payments differently. Starbucks, for example, has arguably the

most successful mobile payments app.

It processes over 6million transactions a

week (15% of its total) and is expected to process almost USD1.5bn in

2014. These numbers are growing at over 75% YOY. It recently announced

that it will open up their platform for others companies to replicate.

Fast food chain, groceries, pharmacies,

gas stations etc. will soon look to replicate this success.

Mobile payments

Some countries are moving straight from

having no bank accounts to mobile payments just like they moved from no phones

to mobile phones. Kenya is the prime example where almost half (2014 est) of

the country’s GDP (USD 45.9bn 2014 est) moves using mobile payment on a service

called MPESA launched by the leading mobile phone operator in the country

called Safaricom (owned by UK’s Vodafone).

Globally, over 50% of the population

does not have a bank account!! And now mobile service providers are entering

this space!

Lending

Even the commercial banking strongholds

are slowly coming under attack – the likes of Funding Circle, Zopa,

MarketInvoice & Bondora are connecting savers to SMEs that

want to borrow, thus eliminating the intermediaries – i.e. banks.

This industry has increased 100% YOY

for the past three years and is expected to surpass USD 1.6bn by year

end.

IB and Venture funding

We all would have read about startups

raising funds on websites like Kickstarter and Crowdcube. Kickstarter has

raised over USD1bn in crowd funding from over 5 million investors!

Crowdcube has raised over £38m from 90,000 investors.

These are small numbers but what’s

important to note is that these are growing exponentially!

Even the Investment banking domains are

not being spared. Loans are now even beginning to be repackaged in to

securities. Some of you eat burritos at a place called Chillango that is

scheduled to raise over GBP 2m in the first ever crowd funded bond offering

(called 'Burrito Bond').

Foreign Exchange

How about financial markets? Retail FX

is being disrupted by companies such as TransferWise, which claims to offer

better rates than all banks – even publishes a comparison on its website. It

increased volumes from USD 200m to USD 1.7 billion in just 11 months!

Wealth management

Startup

wealth managers like Nutmeg and Wealthfront are also making inroads into the

tradition preserve of high heeled bankers.

While these are small numbers but a

clear trend is emerging and the rate of growth is exponential. Retail, corporate or investment banking are all

under attack. All this will impact bank’s revenues; there are

various estimates of this impact - Accenture research estimates about 30% of

the banking revenue pool will shrink, McKinsey puts the same number at ~25%.

What we know for certain is that the

bank’s wallet is going to be lighter!

While on the one hand revenue pools are

shrinking on the other end operating costs have become higher due increased

regulatory burden, causing considerable strain on profitability and returns.

4. Regulatory

overdrive

Ever since the global financial crisis

that hit in 2008 with the failure of Lehman Brothers, there has been a torrent

of banking regulations. The suite of regulations (to name a few Basel

3/CRD4, EMIR, Dodd Frank, FATCA, MiFid, RRP,ICB etc.) taken collectively has

the effect of knocking off over 25% of the returns. The regulations seek

amongst other things:

- Higher capital and liquidity buffers;

- Increased compliance requirements on customer acquisition, remittances and sanctions monitoring;

- Onerous new tax regulations like FATCA;

- Higher margining and collateralisation through centralised clearing houses;

- Recovery and resolution plans; and

- Bank levy

In addition to the above:

- Balkanisation of operations is making the business model increasingly expensive; Each of the regulators, in their desire to keep their jurisdiction insulated, are curtailing the mobility of liquidity and capital for cross border banks; and

- Banks are required to maintain higher levels of buffers locally as well.

All of this has pushed the cost of

operations for banks while revenues have been under attack from non-traditional

players leading a significant squeeze on return on capital for investors in the

sector.

The Return on equity of banks has

dropped from mid-teens to high single digits. A lethal combination of digitisation, changing customer behaviour

and regulatory onslaught will leave the banks like dinosaurs if they fail to

innovate!

And

how are banks coping with new reality?

So where are banks in this dynamic

environment? Banks are not generally known for Innovation. Well not

anymore! Banks very well recognize the threat posed to their business

model and have begun to make changes.

Payments

In the payments space in the UK, several

major banks and building societies have started offering the ability to make

payments to mobile numbers (no bank a/c required) using their mobile banking

app in a service called PayM. Barclays is launching Ping it that allows

payments just using mobile phone number.

And in the near future banks will help

facilitate retail payments through an app called Zapp, which will also attempt

to combine loyalty programs of various retailers.

Some banks are recognizing the power of

social media; Banque Populaire just announced that it will start offering the

ability to make payments via twitter.

Bank Accounts

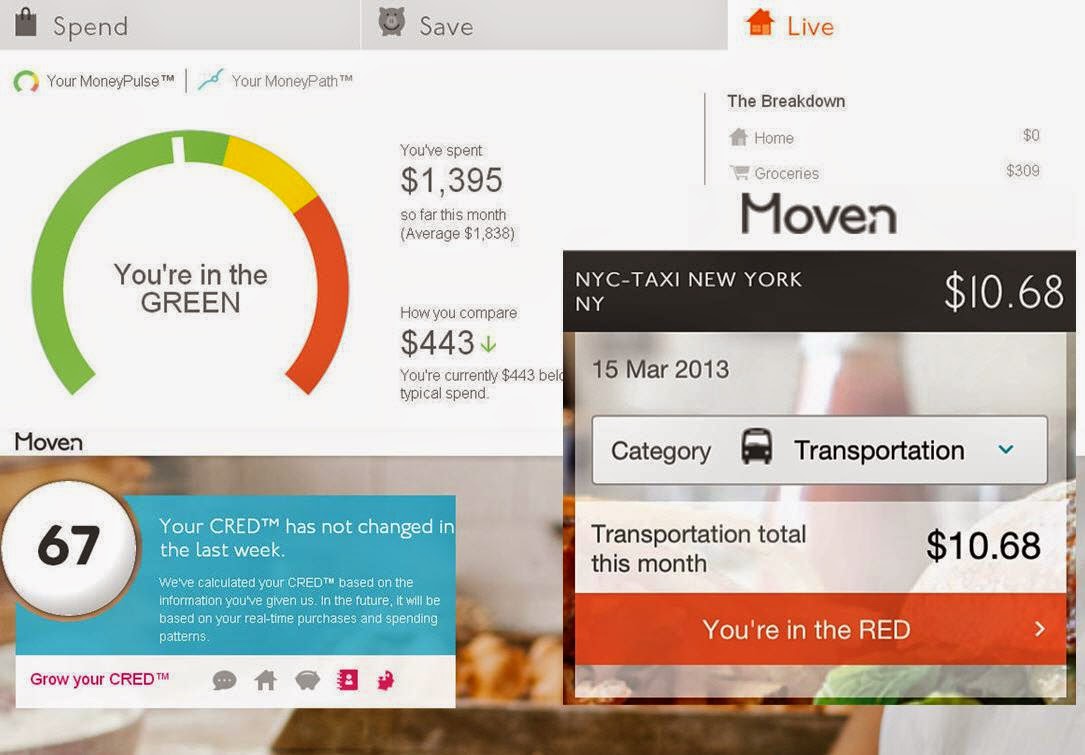

Movenbank, a start-up bank offers

Facebook integration and ability to open initial account by through Facebook.

APPS based Offering

In other geographies, banks such as

Commonwealth Bank of Australia have begun offering services, via its mobile

app, that provide information on real estate properties based on image from the

mobile phone camera of the property.

The bank of the future will aim to help

its clients in everyday financial decisions.

If you wish to buy a house, you

would simply open your banking app and view properties in the budget your bank

has calculated after analysing your income and payments (of course you would be

able to adjust these numbers).

In Asia, Standard Chartered bank offers

its clients, through an App, daily discounts from partner retailers.

The idea

of such apps is to make the bank more relevant to its customers on a daily

basis.

Car Deals – BBVA

BBVA Compass App provides information

on traded price of cars to enable customers to negotiate a better price with

their dealers.

CASHBACK - BOA

Bank of America allows its customers to

choose the retailers for their cash back deals (online) for purchases with a

BOA debit or credit card. The cash back you earn is automatically

credited to their account next month.

Some banks are taking the M&A route

and taking over the innovators as BBVA did in the US through its acquisition

of Bank Simple.

BANKS OF THE FUTURE

I believe that the bank of the future will have to fight hard to make itself relevant to its clients.

Some banks are developing an App that

allows customers to query and track spends by category simply by a voice

command! For example, you can ask how much did I spend at restaurants in

the last six months and you will get information!

It has to act like

an online financial planner for the client by helping them with their personal

financing decisions. Or else, banks are at risk of becoming a back office

transaction processing unit while the front end would be APPS developed by

FINTECH companies.

From buying flight tickets to cinema

offers, banks have the ability to tie up with their corporate clients to offer

the best services to its retail clients. A single app with loyalty offers to

all credit cards and debit cards for payments should be offered by the future

bank.

The ultimate goal is to be able to

offer the customer methods to:

- save and get value on deals;

- help manage their personal finance better; and

- reduce friction and speed up delivery time of financial services.

Like the iPhone has combined the

camera, music player, phone and now credit cards in to a single product, banks

have to create the magic app that combines to meet the customer’s personal

finance needs!

And finally comes the question - How can Finance

drive Innovation?

Finance needs to be at front and centre of the innovation agenda and take the lead to create an environment for:

- digitisation initiatives by creating investment capacity through operational efficiencies;

- investment to move to a single source for information storage, performance and risk measurement, management, external and regulatory reporting;

- deployment of tools to the front-end that provide incisive business performance analysis that looks at profitability from multiple viewpoints;

- monitoring emerging trends and be alert to competition from non traditional sources;

- reshaping the business to capture the revenue pool shift to non traditional players; and

- capital allocation discussions.

I hope this has provided sufficient

food for thought to you to put Innovation at the top of your agenda!

Sridhar, the trends definitely mean, there would be de-mediation and re-mediation. Electronic technology has made access to the customer very easy, but at the same time, has made information availability for the customer to access the bank much more difficult because of the sheer amount of data and the data clutter. This clutter has led to remediation.

ReplyDeleteOne of the major changes that is occurring in the developing countries is the digital micro credits. One of the important function of a bank is access to finance, where Indian banks have performed rather poorly. That space is now being filled by newer intermediaries like Rang De. (https://www.rangde.org/)

I think the innovation in micro credit would further limit the role of commercial banks and give entrepreneurial space, that is so much needed.

I agree with you, banks of the future would be unlike the banks we know them today. I would probably think of them as conduits that carry massive amount of funds and be a back office channel. They will be nameless and formless. I would miss the colorful logos of them for sure.

Very insightful post Sridhar. I think, even now big name banks, even if they are starting to innovate, aren't really putting their heart and soul into tech led innovation-its mostly an afterthought or an extension of the brick & mortar business. The innovate or perish thought process has not yet sunk in, probably since Banking & Fin is such a regulated sector with many barriers to entry that the incumbents think they can take it easy

ReplyDelete